Easier payments.

Maximum savings.

Enjoy easy, regular, flexible energy payments and the cheapest tariffs available with Power Pay.

Easy Savings

Budget-friendly,

flexible energy

Power Pay puts you in more control than ever before. Say goodbye to overpayments ‘trapped’ in your account and hello to hassle-free, flexible energy payments, with a schedule made by you. Start saving £££s today!

No nonsense energy

The way to pay that you’ve always wanted

Only pay for the energy you actually use - no more guesstimates, surprise bills, or overpayments.

Your cash, your rules

No more ‘trapped’ credit balances

Power Pay means you only pay as you use energy. Meaning we don’t lock away any money in credit balances. If you find yourself using less energy than you were forecasted, simply withdraw it back to the card you paid with – simple!

Forecasts

No more guesstimates

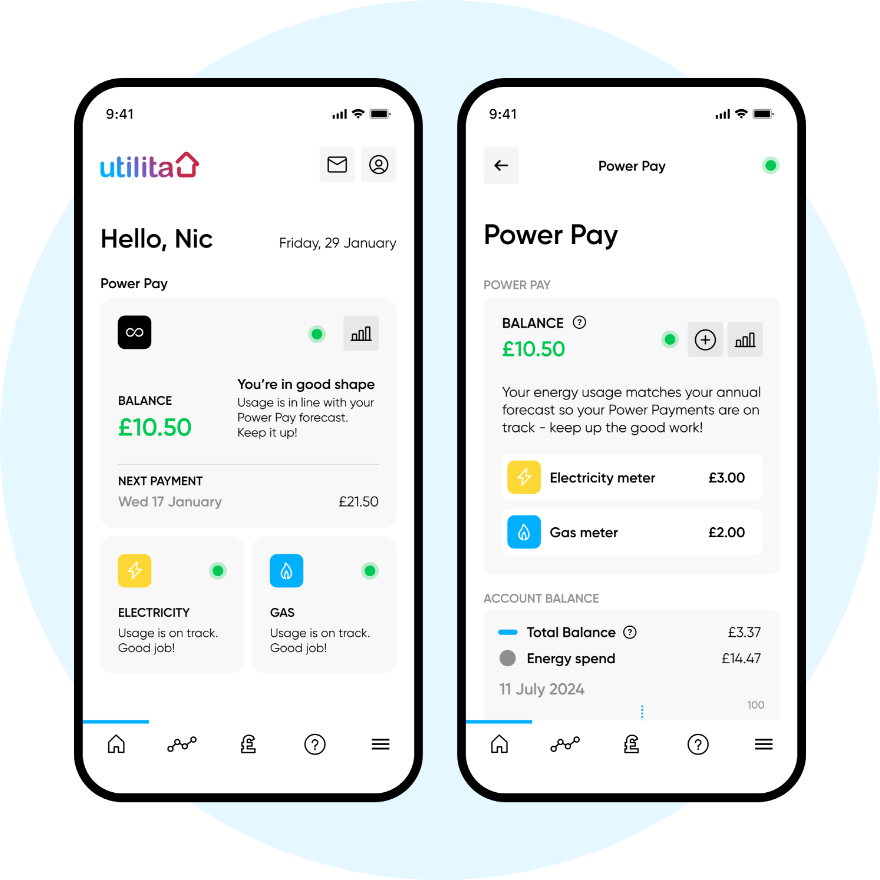

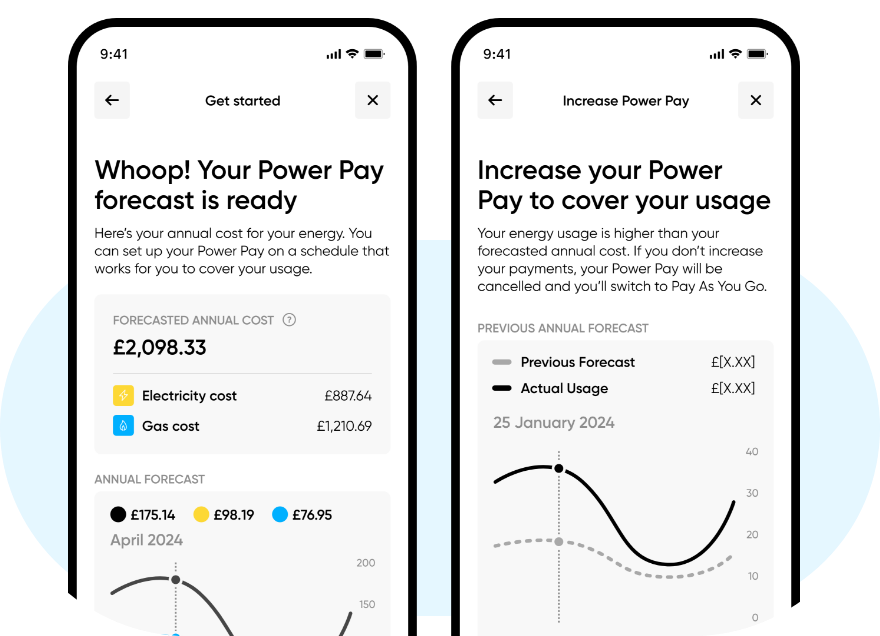

Set up Power Pay in just a couple of clicks with My Utilita. We’ll work out your usage forecast every quarter to determine how much or how little you pay with easy-to-follow graphs. But don’t worry, these aren’t set in stone – we’ll monitor your usage regularly and keep your estimated costs in line with your actual usage.

How does it work?

Step 1

Find Power Pay

Sign in to My Utilita and select Power Pay in your Payments page.

Step 2

Energy forecast

We’ll estimate your energy usage for the next 3 months.

Step 3

Payments

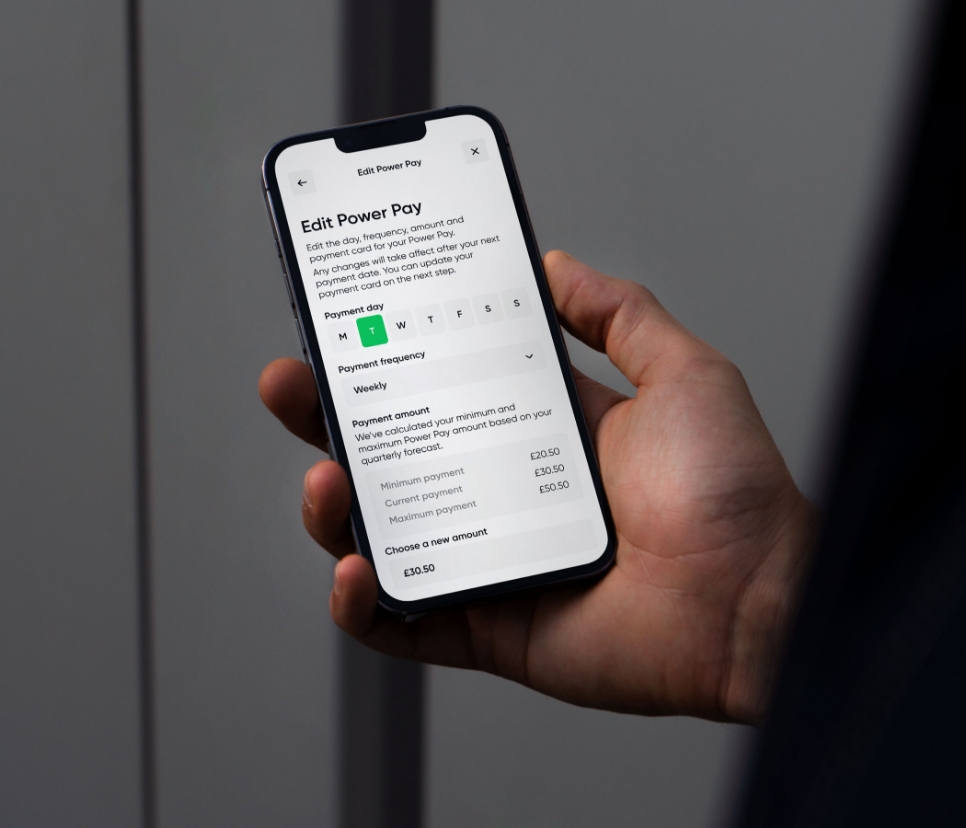

Pick how often you want to pay – weekly or bi-weekly.

Step 4

Choose a card

Choose your card (credit or debit) for easy, direct payments.

Get Started

Ready to pay less?

Unlock the smartest way to pay for energy in just a few taps. Download My Utilita, get your Power Pay forecast, confirm your details, and relax - low tariffs and zero-effort payments are all yours.

FAQs

-

How do I set-up flexible energy payments?

It’s super easy! Open your My Utilita app, go to the Payments section to find Power Pay, and select Set-up Power Pay. Just follow the steps to add your payment card and pick the dates you want to pay. We’ll use data from your smart meter to calculate accurate payment forecasts, so you’ll know exactly what to expect.

-

Who is eligible for Power Pay?

Power Pay is available to customers with a compatible communicating smart meter and currently in credit. Your meter mode will be switched to Prepayment as part of your set-up.

-

Can I use a debit card?

Absolutely! You can use either a credit card or a debit card, as long as you’re the account holder.

-

What if my energy usage changes?

No worries! We review your payments every 3 months alongside Ofgem’s energy price updates to make sure you’re always paying the best rates. If your usage goes up, we’ll let you know and adjust your payments. And if you’ve overpaid, we’ll recalculate and help you reduce your payments – plus, you can get any positive balance refunded to your card if you need it.

-

What if I can’t pay my next payment?

No problem—life happens! Check out the Insights section of Power Pay to track your usage and payment dates. If you think you’ll struggle to make a payment, just get in touch with us. We can adjust your forecast or set up a Recovery Rate to help you get back on track.

-

What happens if I miss a payment?

If you miss a payment, your balance will go negative. You’ll need to increase your next payment to cover your usage. Missing more than two payments? We’ll have to cancel Power Pay and switch your meter back to Pay As You Go. That means you’ll need to top-up manually to keep your power going.

-

Can I cancel Power Pay?

Yes, anytime! We’ll move you back to PAYG and switch your meter over remotely. Any credit left on your account will go to your Savings, where you can transfer it between meters. If you have any debt, you’ll need to pay it back when you top-up using a Recovery Rate.

-

If I pay too much, can I get the money back?

Of course! With Power Pay, positive balances aren’t stuck like they are with Direct Debit. Just head to Withdraw in the My Utilita app and choose the amount you’d like refunded to your card.

-

What happens if a payment fails?

If we can’t take a payment, double-check your card details and make sure there’s enough money in your account. We’ll try again over the next few days. If you keep missing payments, we’ll let you know the next steps, but repeated failed payments might mean we’ll have to cancel Power Pay and switch you to PAYG.

-

Can I use Power Pay if I have debt on my account?

No, however you can clear your debt with a one-off payment and then participate in Power Pay once your outstanding debt balance is cleared.

-

Why is Power Pay the cheapest way to pay?

Power Pay is based on a PAYG tariff, which is now the cheapest payment option thanks to Ofgem’s changes to the price cap for PAYG customers. Unlike Direct Debit, where payments can lead to overpayments or credit getting stuck in your account, Power Pay lets you pay only for what you use, at the lowest rates available. It’s the best of both worlds – flexible payments and maximum savings!

- Terms and Conditions